Over the last few months, a number of Journal subscribers have asked about the difference between value segmentation and price segmentation. To many, these just seem like slightly different terms for the same thing. And technically, that’s not far from the truth…

Developed correctly, a price segmentation is indeed a form of value segmentation. In other words, a sound price segmentation model will reflect and codify the circumstances under which different customers place different values on the offerings, thus resulting in differences in willingness-to-pay.

Technical definitions aside, however, we recognize that these terms are often referring to very different things in practice:

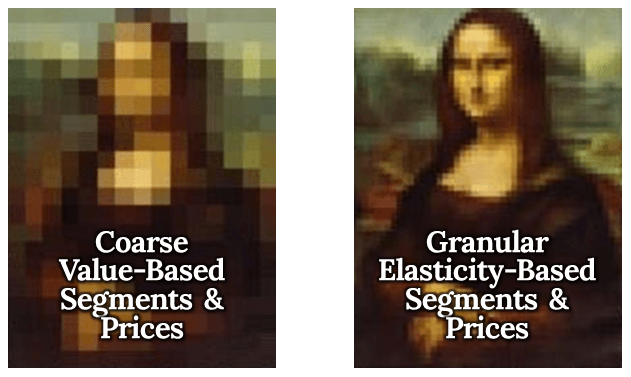

Value segmentation, as it’s known in many businesses, is something that is done early in the product lifecycle, usually before the product is ever introduced. As a segmentation model, it’s often relatively coarse; containing just a handful of the most significant value delineations. And, it’s not uncommon for these value segments to be largely theoretical, and based primarily on secondary research and/or internal conjecture.

Price segmentation, as we see it being utilized by B2B companies, is often developed and refined throughout the remainder of the in-market lifecycle. As a segmentation model, it’s usually very granular and may contain thousands of discrete price segments. And very often, these price segments are based on hard data and factor analysis into different price responses and willingness-to-pay.

In a recent training webinar about lifecycle pricing, we discussed how many companies actually think of value segmentation and price segmentation as parts of a two-step, “refinement” process.

In the first step of this process, the coarse, pre-market value segmentation helps establish the basic ranges and major differences during the development and introduction stages. Then, once there’s some actual in-market data to work with, the more granular price segmentation model provides additional specificity and relevance, to maximize revenues and margins in the heart of the lifecycle.

Yes, value segmentation and price segmentation are similar in that they both reflect differences in perceived value. But in practice, they are very different in their granularity, specificity, and factual basis.

So, is one better than the other? Being much more granular and based on hard data, a true price segmentation model will clearly have more power than the typical value segmentation. But from our perspective, value segmentation and price segmentation both have their place and serve a valuable purpose.