Sometimes a metric that seems completely straightforward becomes far more nuanced once you dig deeper.

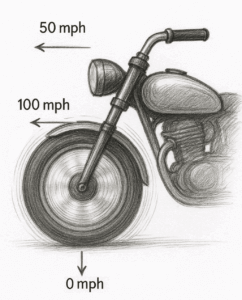

Take this classic physics puzzle: you need to figure out how fast the front wheel of a motorcycle is moving. The speedometer says 50 mph—simple enough, right?

Look closer and you’ll see multiple vectors of motion. The wheel is rolling forward at 50 mph, but it’s also spinning:

- Top of the wheel: The rotational motion adds to the forward motion, so it’s effectively moving 100 mph relative to the ground.

- Bottom of the wheel: The rotational motion cancels the forward motion, so it’s moving 0 mph.

- Everywhere else: Some speed in between.

Depending on your reference point, you can claim the wheel is moving 0, 50, 100 mph—or anything in between. And every answer is technically correct.

Pricing Metrics Need the Same Scrutiny

Pricing teams face a similar challenge. A datapoint can look perfectly clear—until you examine the frame of reference:

- Margin vs. volume trade-offs: A region’s revenue might look great until you account for mix effects and discover margins quietly eroding.

- Discount reporting: Overall discount rate may seem stable, but segmented by customer type or deal size, you may find some accounts receiving far deeper concessions.

- Price realization: Average selling price meets the target on paper, yet mix shifts toward lower-margin SKUs mean you’re realizing far less value than the ASPs imply.

Without the right lens, you can reach wildly different conclusions from the same dataset—each “true” in its own way.

Measure What Really Drives Profit

For pricing leaders, tracking numbers isn’t enough. You need to understand the commercial system behind them:

- Are you isolating product mix, currency swings, and channel effects when you report margin?

- Are you evaluating competitive intensity and customer willingness-to-pay when you review discounting trends?

- Are incentives or approval workflows encouraging behaviors that erode price quality?

The easy-to-grab metric is rarely the most meaningful. As you review your data, ask: “Am I measuring what drives profitability—or just what’s easiest to count?”

Dig Deeper for Better Pricing Strategy

By challenging surface-level numbers and clarifying the frame of reference, you’ll give your organization a more accurate picture of price performance and protect profitability. But knowing what to measure is only half the battle—you also have to communicate those insights effectively and work with data that’s rarely perfect.

To help with both, check out these on-demand sessions:

Our on-demand webinar Delivering Data to Decision Makers explores how leading pricing teams turn analysis into influence. It highlights practical ways to present information so decision-makers see not just the numbers, but the implications—and act on them.

Of course, even the best presentation can’t hide the fact that B2B pricing data is often incomplete or inconsistent. That’s why Working With “Bad” Pricing Data focuses on strategies to extract reliable guidance from messy datasets, helping you make sound decisions even when the inputs are less than ideal.

Together, these sessions show that pricing excellence isn’t about chasing flawless numbers—it’s about understanding context, framing insights for impact, and making confident moves despite inevitable imperfections.