In our live training sessions and research briefings, I tend to speak pretty frankly about the various topics and issues being covered. And as a former practitioner myself, I’m not particularly shy about sharing my perspectives on the relative value, importance, and real world implications and applications of the strategies and tactics we’re highlighting.

But judging from some of the Help Desk questions that came in after the fact, I made some statements in the Driving Consistent Price Execution session that clearly warrant further explanation and clarification…

During this session, when discussing pricing compliance in the field, I stated that sloppy execution of a great pricing model is far and away more preferable than perfect execution or 100% compliance to a crappy pricing model. I also mentioned a case study in the Journal where a product manager destroyed their product line by forcing strict compliance to an overly simplistic pricing model.

It was around these points that some people had follow-on questions. How could perfect execution or compliance hurt anything? Does a great pricing model, poorly executed, really outperform a lame pricing model, perfectly executed? Why would that be? How does that work?

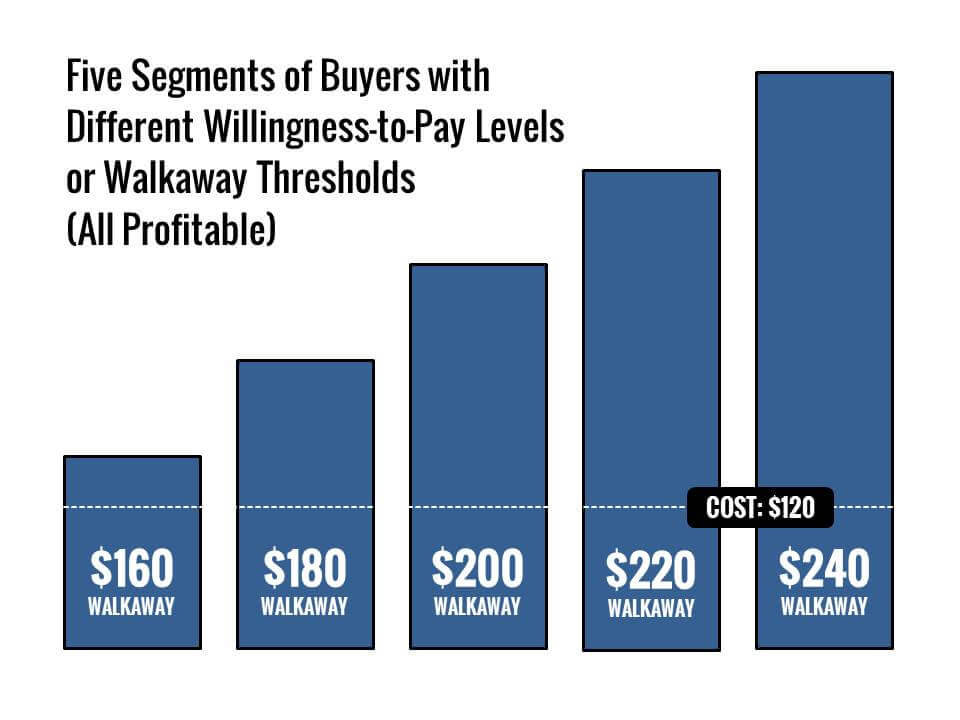

To help clarify, this key concept is predicated on the recognition that different segments of buyers are willing to pay different prices. And a pricing model’s quality, accuracy, and power are determined by the degree to which that model describes and aligns to these various differences in willingness-to-pay.

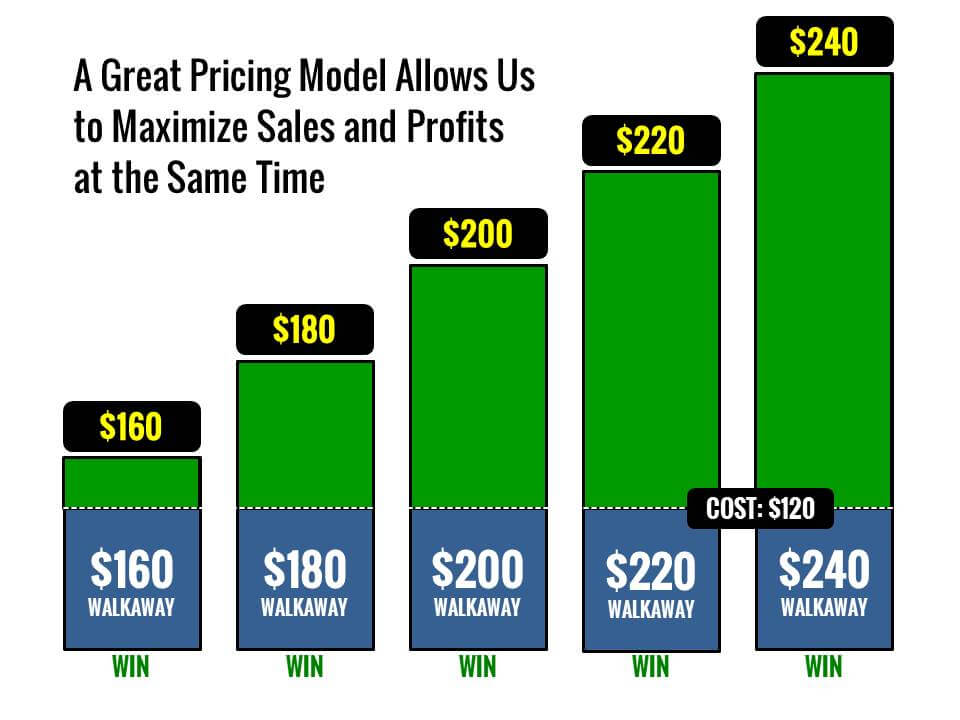

For example, imagine a market that has segments of buyers with five different walkaway thresholds or willingness-to-pay levels for the same offering, all of which are above cost and profitable for us.

A “great” pricing model will have five different price segments, with five different target prices that align as closely as possible to the five different willingness-to-pay levels or walkaway thresholds. Using this pricing model, we can win business in every segment, at the highest possible margins.

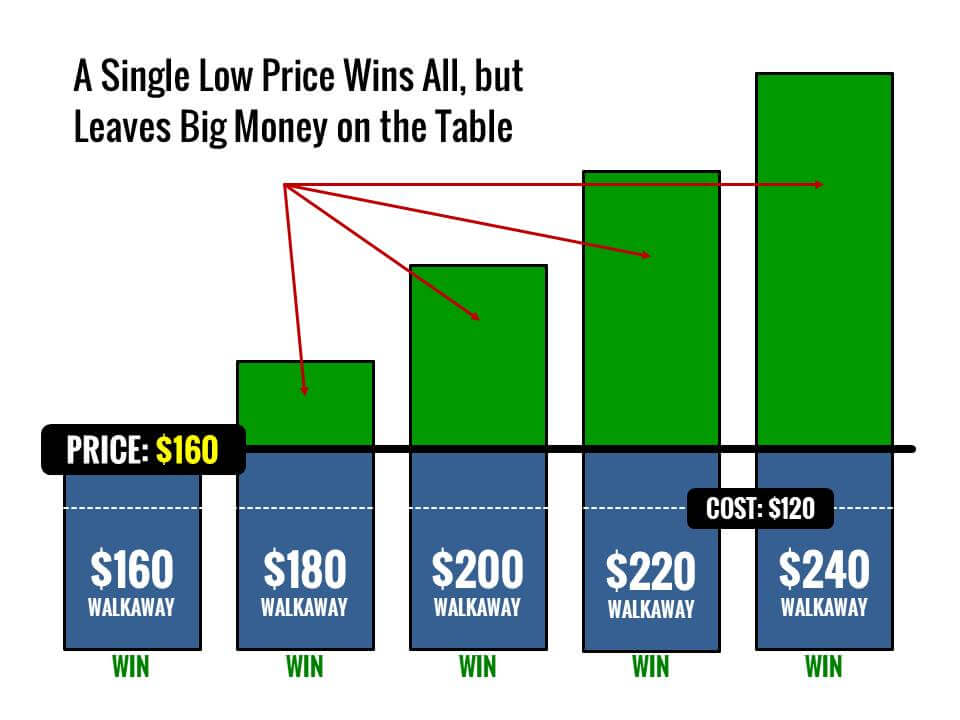

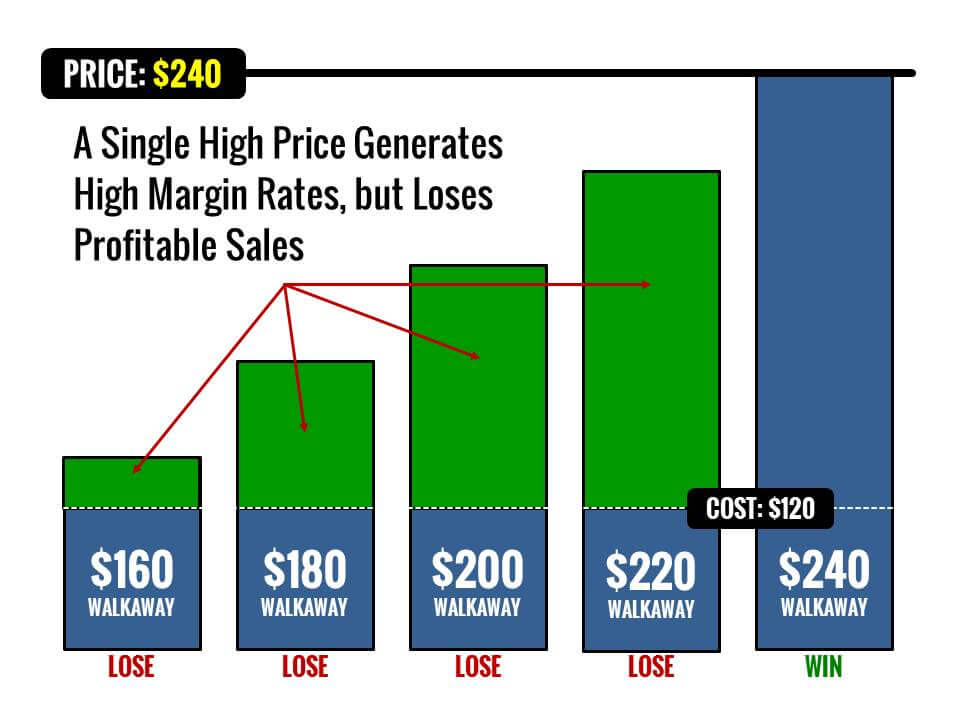

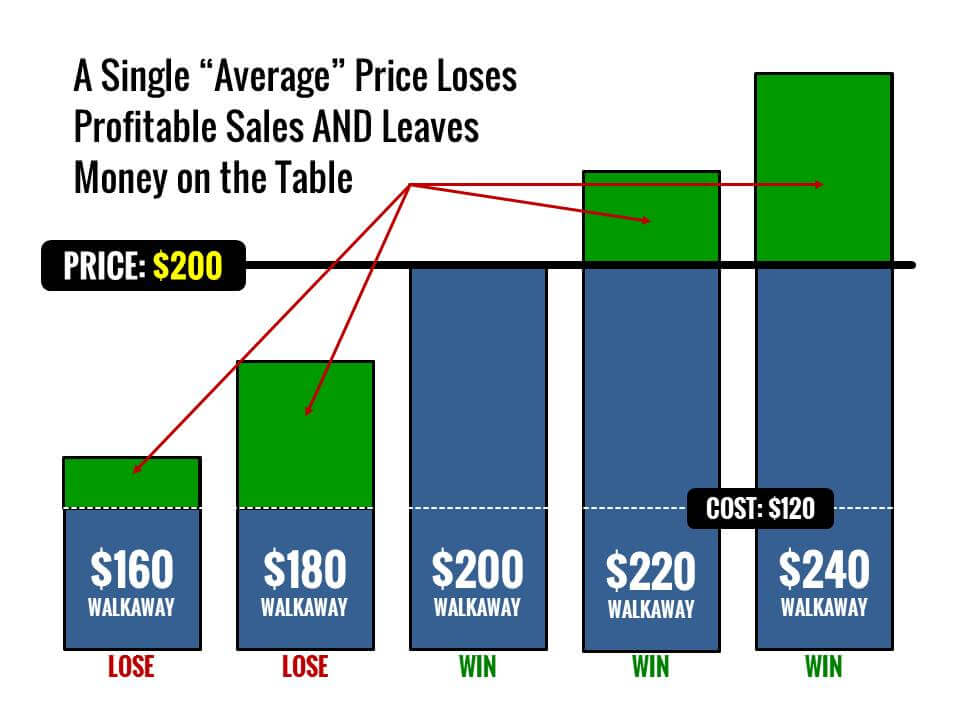

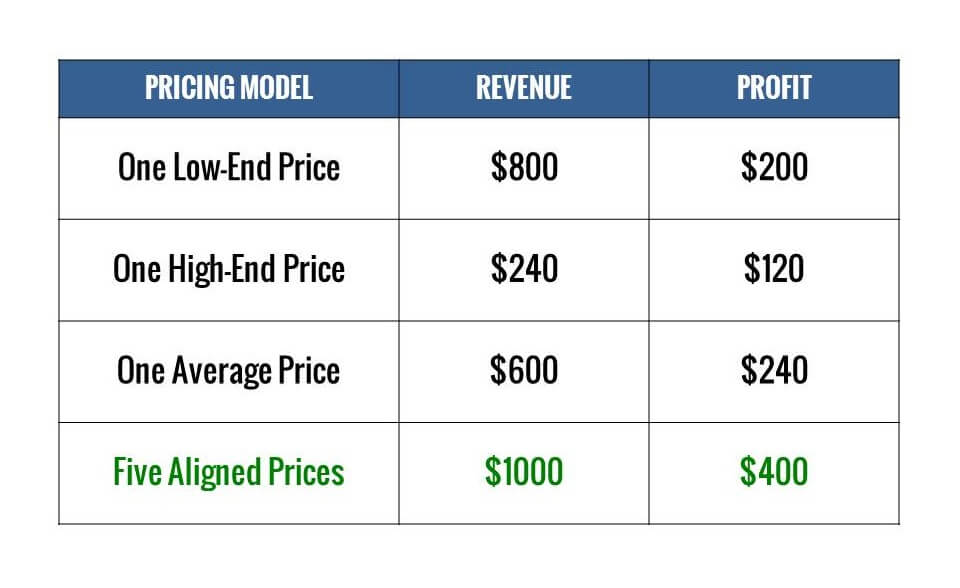

In sharp contrast, a “lame” pricing model will ignore the presence of the five different willingness-to-pay segments altogether and only put a single target price into the marketplace. And because there are actually five segments in the marketplace and not just one, no matter where that single price is set, perfect execution and strict compliance will inevitably result in lost sales, lost margin, or both at the same time.

When we compare the revenue and profit performance of these models it’s easier to see why even sloppy execution of a “great” pricing model is preferable to perfect execution of a “lame” pricing model. After all, the disparity in performance is so significant that it would likely take a total execution meltdown for a great pricing model to perform worse than a lame one, perfectly executed.

While I certainly hope that this article has helped explain and clarify those specific statements, in closing I want to reiterate the overarching points I was making in the training session with respect to pricing compliance…

Before pushing hard for greater pricing compliance in the field, we should make sure that we’ve got our house in order and we’ve done the legwork to be confident that our pricing model is sound. And we should always remember that the more accurate we can make our pricing models, the easier it becomes to ensure proper and consistent price execution in the field.