In The Fundamentals of Value-Based Pricing webinar, we spent over 90 minutes cutting through the confusion and apparent complexity to expose the core concepts and processes that produce the biggest bang for the buck. To illustrate one of the most important value-based pricing concepts, I recounted this little story:

When guest lecturing at a local university, I held up a little gray piece of stone that I brought from home. Then, I passed out a “spec sheet” for the stone to each member of the class. After giving the students plenty of time to read the spec sheet, I asked them to raise their hands if they thought the stone was worth at least $50.

Half the class raised their hand…while the other half stared at them in utter disbelief and amazement. What was going on? Why did half the class assign a value of more than $50 to a rock the other half believed to be worthless?

I had handed out two different spec sheets, of course.

One spec sheet contained just the “speeds and feeds” —- i.e. the size and weight of the stone, its mineral composition, its geographic origin, etc. The other sheet had all of that information, plus the fact that the stone had actually come from the face of the sheer cliff under Edinburgh Castle in Scotland…the cliff that was scaled by a Scottish “special forces” team in a daring night assault that succeeded in ousting the English army and recapturing the fortress for Robert the Bruce in 1314.

While both spec sheets were entirely accurate and truthful descriptions of the same hunk of rock, they created very different appraisals.

The underlying concept I sought to illustrate through this demonstration was that “value” is largely a perception. For the most part, value is a product of the mind. It’s an idea, based on whatever information and signals happen to be rolling around in the brain at the time. And when the information and signals change, so too do the perceptions and estimations of value.

When it comes to dealing with customers and prospects, it’s crucial to always remember that value is not what you think it is…value is what they think it is.

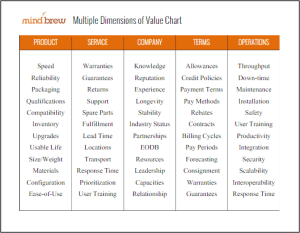

Of course, having a strong conviction on your part sends an extremely powerful signal. The pricing number itself provides yet another strong signal. Defining the alternatives and speaking to the relative differences feeds advantageous information into the ideation process, as does the identification and quantification of specific economic benefits. In value-based pricing, all of these things…and many more…have very important roles to play.

But you should never confuse the “means” with the “ends”.

You don’t want to fall into the trap of thinking that producing the various process outputs and deliverables typically associated with value-based pricing is the ultimate objective. These things are not the “ends” in and of themselves, but rather the “means” through which you can reach the real objective….which is always located squarely between the buyers’ ears.